I Couldn't Make Up Shit This Bizarre....

Saturday, May 13, 2006

Under a new law that took effect Jan. 1 in Tennessee,

drug dealers will be required to pay excise taxes

on illegal substances, including marijuana, cocaine,

moonshine, and unlawfully obtained prescription painkillers,

the Elizabethton Star reported Jan. 2.

The Tennessee law was modeled after a 14-year-old law

The Tennessee law was modeled after a 14-year-old law

in North Carolina, under which the state has collected

$83 million since its inception. At least 22 other states

tax illegal drugs. According to the Tennessee Department

of Revenue, a 10-person tax agency has been created to

collect the tax from drug dealers who go to any of the

state revenue offices within 48 hours of coming into

possession of illegal drugs. When the dealers pay the tax,

they receive a stamp to show the tax has been paid.

The dealer is not required to provide any identifying information. In addition, state tax collectors are prohibited by

The dealer is not required to provide any identifying information. In addition, state tax collectors are prohibited by

privacy laws from reporting drug dealers to police. The tax would also be collected from drug suspects after police

make drug busts. Under the law, law-enforcement agencies are required to call tax officials within 48 hours of finding drugs. If the suspect is unable to pay the tax, the state can seize and sell assets such as cars, homes, and personal belongings. Monies collected from the tax will go to the law-enforcement agency making the drug bust, as well as the state's general fund.

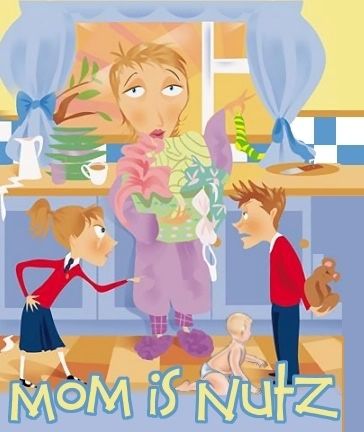

<< Back to Mom Is Nutz